This is part three of an ongoing series about trying to move away from Quicken 2007 for Mac. The previous two parts of the series are here:

As I’ve mentioned before, I maintain two separate Quicken accounts: one with my personal data, and one with my household data. The household data is the smaller dataset of the two, so I’m using that as my test case for importing into potential Quicken replacements.

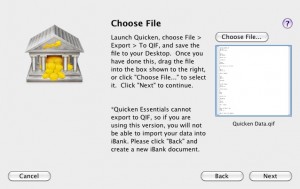

iBank has a 30-day free trial available on its website, so I downloaded and installed it. On first launch, it detected that I didn’t already have a data file, and gave me the opportunity to import my data file from Quicken. I didn’t expect that I’d have explicitly export my Quicken data into a QIF. Exporting to a QIF took a few minutes, and resulted in a 360-KB QIF file. Then I dragged the file into the iBank importer, which (oddly) gave me a teensy preview of the file. I’m not quite sure what the point of this preview is.

iBank has a 30-day free trial available on its website, so I downloaded and installed it. On first launch, it detected that I didn’t already have a data file, and gave me the opportunity to import my data file from Quicken. I didn’t expect that I’d have explicitly export my Quicken data into a QIF. Exporting to a QIF took a few minutes, and resulted in a 360-KB QIF file. Then I dragged the file into the iBank importer, which (oddly) gave me a teensy preview of the file. I’m not quite sure what the point of this preview is.

After selecting my QIF for import, I was then prompted to save my document. I was surprised that I was expected to decide the filename here, and not entirely sure what “document” means. I’ve been using Quicken since the dawn of time or thereabouts, so I’m not used to thinking about how it stores its data. I’m not sure what lies behind the design decision to force the user to think about both the name and location of their datafile. Shouldn’t they at least provide a reasonable default?

After going through the last question of currency, it started importing. iBank showed a determinate progress indicator, but didn’t give me an estimate of how long it would take. My file took about a minute to import.

After importing, I was given a list of my accounts and account types, and asked to choose the most appropriate type for each account listed below. It noted that iBank supports more account types than QIF1, but didn’t give any guidance as to why I might want to select a different type of account. For example, my mortgage imported as the “liability” account type, and iBank has both “liability” and “loan”. Why would I choose one over the other? Can I change this later? This drove me to check the “Quick Start Guide”, which didn’t help, so I had to go grab the full manual. There, I learned that a loan has a payment schedule and a liability doesn’t. So I changed the account type for my mortgage to loan, and also changed a couple of accounts from chequing to savings, and left the others unchanged.

At this point, I was out of time, so I quit iBank for the evening. Overnight, I realized that my account data isn’t the only data that I’ve got in Quicken, and wrote that blog post. As I was writing it, I opened iBank quickly to make sure that I had a couple of details right, and was surprised to see that iBank prompted me with the “Welcome to iBank” screen that I got on my first run. On doing some research, I discovered that it’s a known bug with a workaround. Additionally, I noticed that iBank wasn’t saving my window size and location information. That was pretty annoying. The workaround that seems to have resolved the document-prompt issue also seems to have addressed this issue. While I’m glad that it’s a known issue with a workaround, it undermines my confidence in the application to hit such a bug first thing out of the gate.

My confidence is shaken, but still I’ll soldier on. Now that I’ve gotten my transaction data into iBank, the next step is to try to actually use it. Wish me luck …

- But not Quicken? I’m not sure what it means here, or why it would draw a distinction between Quicken and QIF. ↩